Notice: Co/LAB Lending Franchise offers services exclusively for mortgage broker owners and loan officers. We provide consulting and support for licensing, compliance, and business operations not mortgages, banking, or consumer financial services. Our products are not intended for mortgage consumers.

Your Trusted Back Office Support Team

Take Your Mortgage Business to the Next Level with Concierge Services

Focus on Closing Loans—Let Us Handle the Rest

Our Expertise:

Superior Mortgage Broker Support

Managing the operational side of a mortgage brokerage can be overwhelming, from compliance to financial management and everything in between. Our Concierge Service is here to free you from the complexities of back-office tasks, so you can focus on what really matters—growing your business and serving your clients. Whether you’re just starting your brokerage or need support to optimize your existing operations, we’re here to help streamline every process, boost efficiency, and ensure compliance every step of the way.

Key Benefits

Benefits:

Co/LAB Mortgage Broker Concierge Service

Our Mortgage Broker Support Services are designed to give your brokerage a strategic advantage by streamlining operations and reducing overhead. With our expert team handling the details, you gain the freedom to focus on growth. Explore how our tailored support can enhance efficiency, drive cost savings, and position your business for long-term success

Cost Efficiency with Outsourced Support

Save on operational expenses by outsourcing critical functions to our expert team. Eliminate the overhead costs of hiring, training, and maintaining in-house staff, including wages, benefits, and office space—allowing your brokerage to reinvest in growth.

Refocus on Growing Your Core Business

Free up time and resources by letting us handle the backend tasks. With our support, your team can concentrate on building client relationships and increasing loan volume—driving growth where it matters most.

Access to Specialized Expertise

Leverage the skills of our seasoned professionals in mortgage operations, compliance, and financial management. Our team's expertise means faster results and higher-quality outcomes, without the steep learning curve or cost of building in-house capabilities.

Scalable Solutions for Every Stage of Growth

Adapt to market changes with ease. Our services allow your brokerage to scale up or down quickly, meeting increased demand without the delays of hiring or training new staff—keeping you competitive in a fluctuating market.

Flexible Support That Adapts to Your Needs

Adjust resources as your business needs change. Our services provide the flexibility to allocate or reduce support as required, ensuring that you’re always prepared for market shifts and seasonal demands.

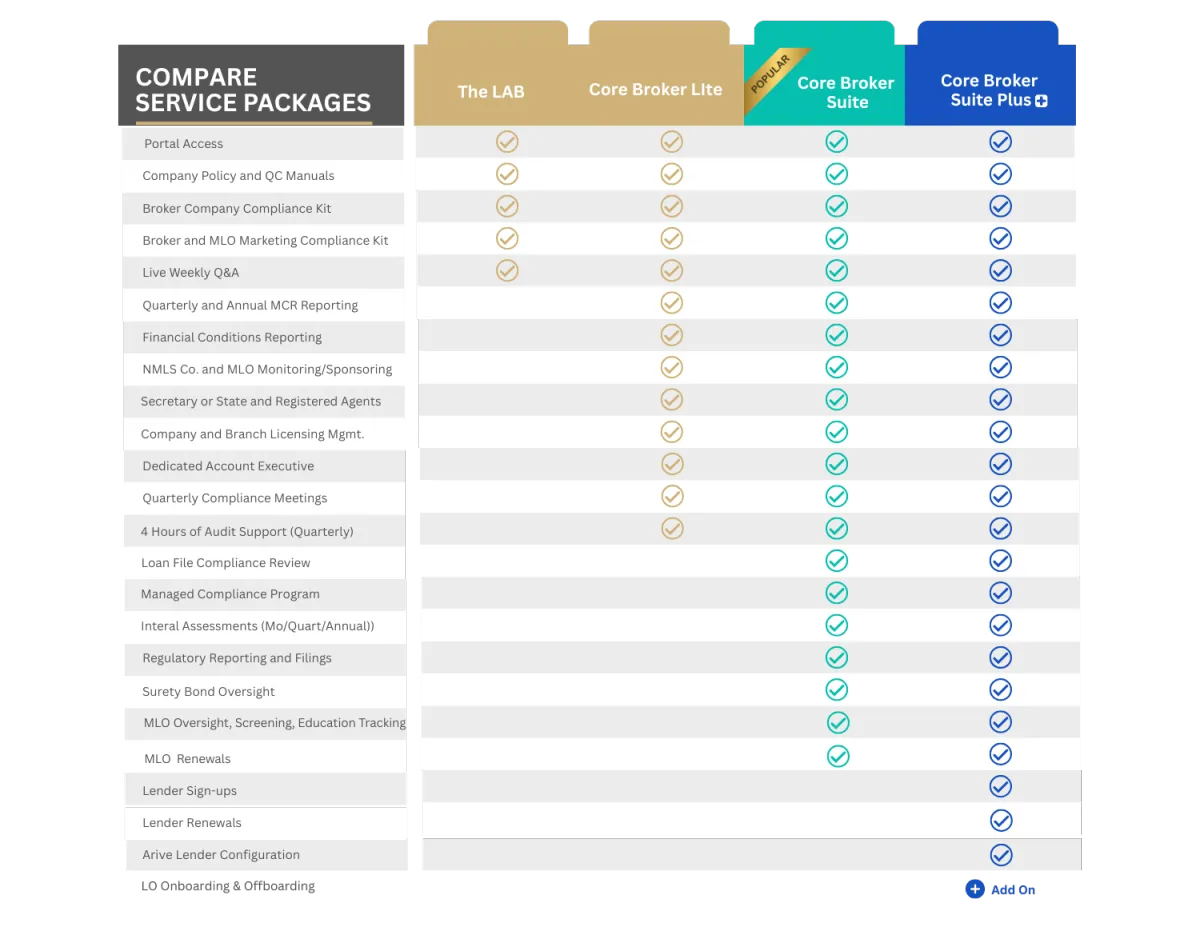

Support Packages for Your Growing Business

Choosing the right plan is crucial for your business growth. We offer tailored plans that fit your current needs and scale with your ambitions. Whether you're just starting out, expanding your team, or leading a large enterprise, we have a solution designed for you.

Core Broker

LAB

What's Included

Policy and Procedure Manual

Quality Control Manual

Company Compliance Kit

Advertising Compliance Kit

Marketing Compliance Kit

Support

Live Weekly Q&A

DONE FOR YOU

Core Broker

LITE

What's Included

Everything in the LAB, plus:

Compliance

Mortgage Call Reports (MCR)

Annual MCR

Financial Condition Report

Closed Loan File Reviews

Licensing

NMLS Updating and Monitoring

Secretary of State & Registered Agent Oversight

Company and Branch Licensing Management

Support

Dedicated Account Executive

Quarterly Compliance Meetings

Plan Includes Support For

1 State License

2 Branches

Upto 3 MLOs

Have more licenses or branches?

DONE FOR YOU

Core Broker

SUITE

What's Included

Everything in the LITE, plus:

Compliance

Mortgage Call Reports (MCR)

Annual MCR

Financial Condition Report

Closed Loan File Reviews

Licensing

Surety Bond Oversight

Secretary of State & Registered Agent Oversight

Company & Branch License Maintenance

Individual LO Renewals

Annual License Renewal Season Support

Support

4 hours of Audit Support

Plan Includes Support For

1 State License

2 Branches

Upto 3 MLOs

Have more licenses or branches?

DONE FOR YOU

Core Broker

SUITE PLUS

What's Included

Everything in the SUITE, plus:

Compliance

Mortgage Call Reports (MCR)

Annual MCR

Financial Condition Report

Closed Loan File Reviews

Support

Four 15 minute appointments per month. Schedule as needed.

Plan Includes Support For

1 State License

2 Branches

Upto 3 MLOs

15 Lenders

Have more licenses or branches?

Ready to Streamline Your Mortgage Business?

Schedule a Call Today to Get Started.

Key Support Areas

Licensing Management

We manage every aspect of business formation and the state licensing process, from application to approval. Our team ensures all licensing requirements are fully met to guarantee regulatory approval, so you can start your mortgage brokerage with confidence.

Compliance Management

Compliance is continuously monitored to ensure your brokerage is always prepared for audits. From managing NMLS licensing and reporting to conducting regular compliance assessments, every requirement is handled to keep your business aligned with industry regulations.

Financial Guidance

Financials are thoroughly reviewed to identify areas where budget adjustments are needed, ensuring your brokerage is on a path to profitability. Using our proprietary Company Health Tool, we assess your financial strength and provide actionable insights to improve your business's long-term success

Lender Coordination

Our team recommends the best wholesale lenders for your brokerage, completing the entire application process on your behalf. We also manage lender renewals as they come due, ensuring continuous access to competitive lending options without any effort on your end.

How we Help

Our Clients:

What do They Say?

Our clients trust us to handle the details while they focus on what matters most—building their business. See how we've made an impact.

Our Goal:

Commitment to Your Growth

Choosing the right partner to support your mortgage brokerage can make all the difference. Here's why so mortgage brokers just like yours trust our Concierge Service:

About Us

Proven Expertise in the Mortgage Industry

With over 20 years in the mortgage business our team has extensive experience working with mortgage brokers and loan officers, managing every aspect of their business operations. From compliance to financial optimization, we understand the unique challenges of running a successful mortgage brokerage.

Tailored Solutions for Every Business

We don’t offer a one-size-fits-all approach. Each service we provide is customized to meet the specific needs of your brokerage, whether you're just starting out or looking to optimize your existing operations.

Commitment to Your Success

We go beyond simply handling tasks—we partner with you to ensure your brokerage thrives. Our goal is to help you reduce operational burdens while maximizing your profitability and growth potential.

Audit-Ready Compliance & Licensing

With our proactive compliance management and licensing management, your business will be ready for any regulatory audit and positioned for long-term profitability.

Contact Us

Get in Touch With Us Today

Ready to get the support your mortgage business needs to grow? Reach out to us today by scheduling a call or completing the form and let us know how we can help.

(814) 240-3299

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

COMPANY

CUSTOMER CARE

FOLLOW US

SERVICES

LEGAL

Co/LAB Lending Franchise offers services exclusively for mortgage broker owners and loan officers. We provide consulting and support for licensing, compliance, and business operations not mortgages, banking, or consumer financial services. Our products are not intended for mortgage consumers.

Copyright 2025. Co/LAB Services. All Rights Reserved.